Nifty Slips Below 26,200 as Reliance Tumbles 5%; Key Supports in Focus

Team SAHI

Market Today: Heavyweights drag, What’s next?

Markets closed lower as sharp selling in Reliance, HDFC Bank and ITC weighed on benchmarks. Bank Nifty showed relative strength, supported by ICICI Bank and insurance names. Market breadth stayed weak at 2:3.

Nifty printed an indecisive candle, with 26,050–26,075 emerging as a crucial support zone. Bank Nifty formed an inside bar, keeping 59,850 as key support. Sensex slipped below its 20-DMA, with 84,650 now the next downside level.

Key Levels to Watch | January 07, 2026

| Index | Support | Resistance |

|---|---|---|

| Nifty | 26,075 & 26,000 | 26,250 & 26,335 |

| Bank Nifty | 59,850 & 59,500 | 60,250 & 60,450 |

| Sensex | 84,650 & 84,400 | 85,250 & 85,550 |

Sector & Stock Moves: Where was the action?

Pharma stocks led the session, followed by PSU banks and IT, as selective buying remained visible. Financials stayed steady, with ICICI Bank and Insurance stocks seeing interest ahead of monthly data.

Oil & Gas stocks dragged, with Reliance logging its sharpest single-day fall in 10 months. Trent slid 8.63% to end as the Top Nifty loser on weak revenue growth, while ITC remained under pressure.

Stock-specific action saw IEX jump 10.63% on market coupling developments, Divi’s Labs gain on positive brokerage notes, while Kotak Mahindra Bank, Kaynes Technology, Swiggy and Eternal faced selling pressure.

NIFTY50: Top Movers

| Gainers | Losers |

|---|---|

| APOLLOHOSP +3.74% | TRENT -8.63% |

| ICICIBANK +2.89% | RELIANCE -4.47% |

| HDFCLIFE +2.44% | ITC -2.07% |

Open Interest Insight

Put writing at 26,000 (9.94L) hints at base formation, while aggressive call writing at 26,200 (45.52L) and 26,300 (25L) signals strong overhead supply. PCR-OI remains near 0.9.

Implication: The setup favours a range-bound market, with sell-on-rise behaviour unless fresh momentum emerges.

Stocks on the Move

| Stock | % Move | What’s happening |

|---|---|---|

| IEX | +10.63% | Trading near the upper end of the range above 152; breakout may extend gains |

| DIVISLAB | +4.38% | Continuation breakout past OI resistance near 6,600 |

| APOLLOHOSP | +3.74% | Double-bottom reversal breakout at 7,215 with strong volumes |

| TATACONSUM | +2.39% | Consolidation breakout to a fresh 52-week high |

| RELIANCE | -4.47% | Selling pressure amid supply concerns; supports at 1,475 & 1,445 |

News You Can Use

- India Services PMI eases to 58.0 in December from 59.8

- Composite PMI slips to 57.8 from 59.7

- IPM value growth steady at 10.6%

- Paisalo Digital announces ₹188.5 crore fund raise

- IEX jumps after developments in the market coupling case

Q3 Business / Result Updates

- HDFC Bank: Advances up 11.9% YoY to ₹28.4 trillion; AUM up 9.8%

- Axis Bank: Gross advances rise 14.1% YoY; deposits up 15%

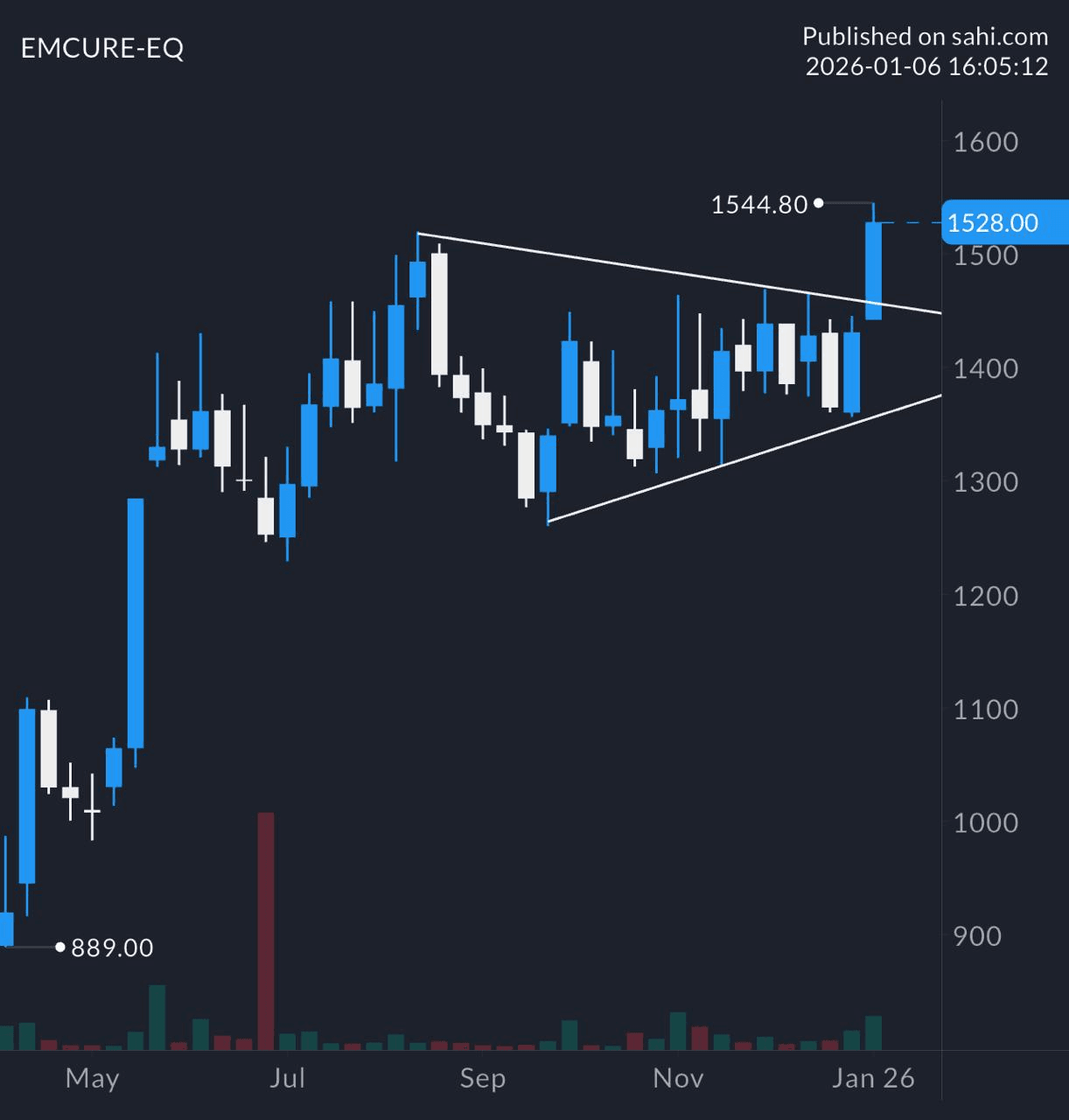

Chart of the Day: EMCURE (Weekly)

Pattern: Symmetrical Triangle

- Structure: Lower highs and higher lows indicate balance

- Validation: Break beyond the boundary with volume confirms direction

- Insight: Often leads to a strong directional move post-breakout.

Related

Recent

Fed's 2026 Outlook: Economic Resilience Meets Persistent Inflationary Pressures

Geopolitical Brinkmanship: Trump-Iran Tensions and the Indian Market Outlook

Zydus Lifesciences Disrupts Respiratory Care with India’s First Drug-Free Device 'Pepair' at ₹990

Infosys Pivots to 'AI-First' Era: New Framework Targets $300 Billion Market Opportunity

Zydus Lifesciences Disrupts Respiratory Care with India’s First Affordable Drug-Free Device ‘PepairTM’ at ₹990